Tuesday Market: Is It Time to Panic or Time to Buy? (Or Just Cry?)

Liquidity Crisis or Bull Market Speed Bump? Breaking Down Crypto’s $325B Meltdown

Crypto markets have been wrecked—again. Since Friday, $325 billion has disappeared, and just today, $100 billion vanished in the last 24 hours, like a magician pulling a rabbit out of a flaming dumpster. No major headlines. No big scandals (unless you count the daily circus that is crypto). Just good old-fashioned panic-selling and disappearing liquidity. So, what’s going on? Buckle up—let’s look at this messy situation together.

First up, Solana is bleeding out, down 22% since Friday, and dragging the rest of the market into the abyss with it. It looked like an isolated problem at first—kind of like watching a ship sink from the shore—until Bitcoin said, "Hold my beer," and dived right in. The timing wasn’t great, considering the S&P 500 started tanking on Friday, making it clear that risk assets are once again playing follow-the-leader. And today, Bitcoin breaking below $98,000 was the cherry on this melting ice-cream

Meanwhile, memecoins—are drying up faster than a Ponzi scheme after bad press, Is the party over?. At the height of the madness, Solana was riding the wave of memecoin euphoria, but as traders cashed out their lottery tickets, Solana lost its momentum too. It’s almost poetic—if watching your portfolio burn counts as poetry.

Just as things were getting weird, Citadel Securities announced plans to become a crypto liquidity provider. The timing of this move is suspicious—like a firefighter showing up right before the blaze. Market makers don’t just randomly step into crypto unless they see a chance to control the flow of money. So, are they here to save the market or feast on the remains? Either way, liquidity is looking like it just got rug-pulled

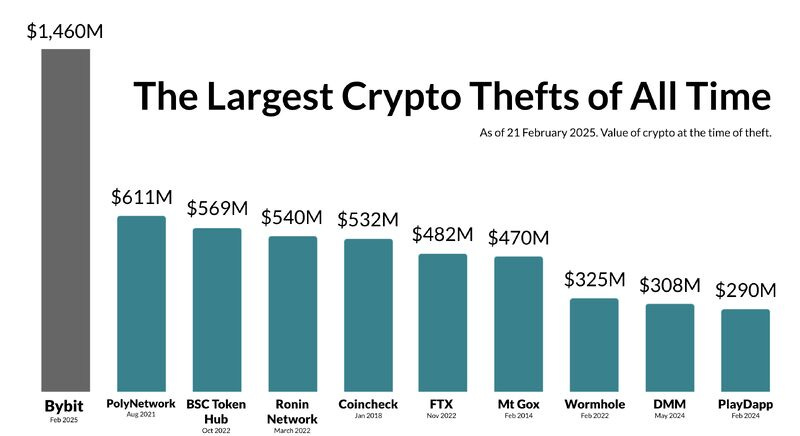

And let’s not forget the Bybit hack on February 21st—now officially the biggest financial heist in history, according to Arkham Intelligence. That’s right, folks—bigger than the infamous $1 billion Central Bank of Iraq robbery in 2003. In fact, this hack more than doubled the previous biggest crypto exploit, which was the PolyNetwork’s $611M loss in 2021. Crypto has had its fair share of crimes, but when hackers start making history, you know something’s broken. And guess what? Markets hate bad press.

Oh, and Ethereum? It’s looking as weak as a diet coke (my least favorite drink), adding even more pressure to the already crumbling market. The technical momentum is gone, and the charts look like a slow-motion car crash. But, before you start writing crypto’s obituary, remember: Bitcoin has survived countless 10%+ crashes in every bull market. It’s like a cockroach—it always comes back, no matter how many times you think it’s dead.

And just when we thought today couldn’t get any more bizarre, Sam Bankman-Fried made a surprise return to X. Yes, that SBF. His first public comment after he was arrested? His cryptic message about having "sympathy for government employees" arrived just as Elon Musk’s companies prepare for potential mass layoffs in federal agencies—a strange coincidence or an intentional jab? Btw, my boss has asked I send weekly mail on what i achieved the previous week, thanks alot Mr. Elon of DOGE. 😭

Ultimately, today’s bloodbath comes down to one thing—crypto needs liquidity to survive, and right now, it’s nowhere to be found. After an era of wild speculation, the market is pulling back, and the money printer isn’t saving the day this time. If history tells us anything, this isn’t the first time crypto has gotten smacked, and it won’t be the last.

It’s not just crypto taking punches—Wall Street is wobbling too. The stock market is locked in its own battle, with the S&P 500 and risk assets feeling the heat, proving that when fear takes over, no market is safe.

For real-time updates as this madness unfolds, subscribe to The Money Mindset—because watching your portfolio implode is more fun when you understand why. 😉