The Best Day of Stock Trading This Year: What's Really Happening?

Markets Soar, Gold Breaks Records, and Crypto Rises from the Ashes

If you read my last article, you’d probably think I was confused. Just a few days ago, I was talking about Nvidia’s staggering $1.6 trillion loss over the past three months, bringing its market value down from $3.6 trillion at the end of last year to $2.6 trillion as of Friday morning. Yet here I am, telling you that the last few hours have seen a massive $1.3 trillion surge in the stock market. The S&P 500 just had its best trading day of 2025—its best, in fact, since before the U.S. elections last November. If you’d told investors yesterday that the S&P 500 would stage its best rally of 2025 today, they’d have laughed harder than a TikToker watching a Nollywood meme. But here we are: $1.3 trillion magically reappeared in the stock market in four hours. The Dow surged 600 points, the Nasdaq leapt 2.6%, and the S&P 500 climbed 2.1%—its biggest gain since before the 2024 election. Investors haven’t fully recovered their highs for the year, but many had already started bracing for a difficult season. So what changed? Is this the result of Trump’s tariff policies creating uncertainty, or is there something larger at play?

The headlines tell the story of a market in whiplash. Just ten hours ago, Yahoo! Finance ran with: “S&P 500 Ends Down, Joins Nasdaq in Correction. Dow Slides as Trump Zeroes in on EU Tariffs.” But one hour ago, a new narrative took shape: “Stock Market Today: Dow, S&P 500 Soar, Nasdaq Rebounds in Best Day Since November to Cap Volatile Week.” So what’s behind the sudden optimism? A few key factors: concerns over a government shutdown eased as Senate Democratic leader Chuck Schumer backed off from blocking a funding bill. Inflation data also came in slightly more favorable than expected, potentially influencing the Federal Reserve’s next moves. But at the same time, lingering trade war fears and tariff uncertainties are keeping investors cautious, as seen in the surging price of gold.

Gold Surges as Markets Seek Stability

While equities saw a dramatic bounce, gold surged past $3,000 an ounce for the first time, signaling that investors are still hedging against uncertainty. The yellow metal has been on a tear, rising 27% in 2024 and outpacing the broader stock market, which has struggled under volatility. Former Treasury Secretary Larry Summers pointed out that gold’s rise is a clear signal of investor anxiety. “That’s what people do when they don’t have confidence in the people managing the country,” he said.

Why? Tariff chaos, geopolitical instability (Russia rejected a Ukraine ceasefire), and central banks like China hoarding bullion like it’s the last plate of jollof rice at a wedding. Gold’s up 15% this year alone, while the S&P 500 is down 4%. Even Goldman Sachs is betting on $3,100/oz by December. The message? Investors are hedging against a world where Trump’s trade wars collide with shaky growth—and crypto’s still too wild for Grandma’s portfolio.

Crypto Re-emerges as Market Sentiment Shifts

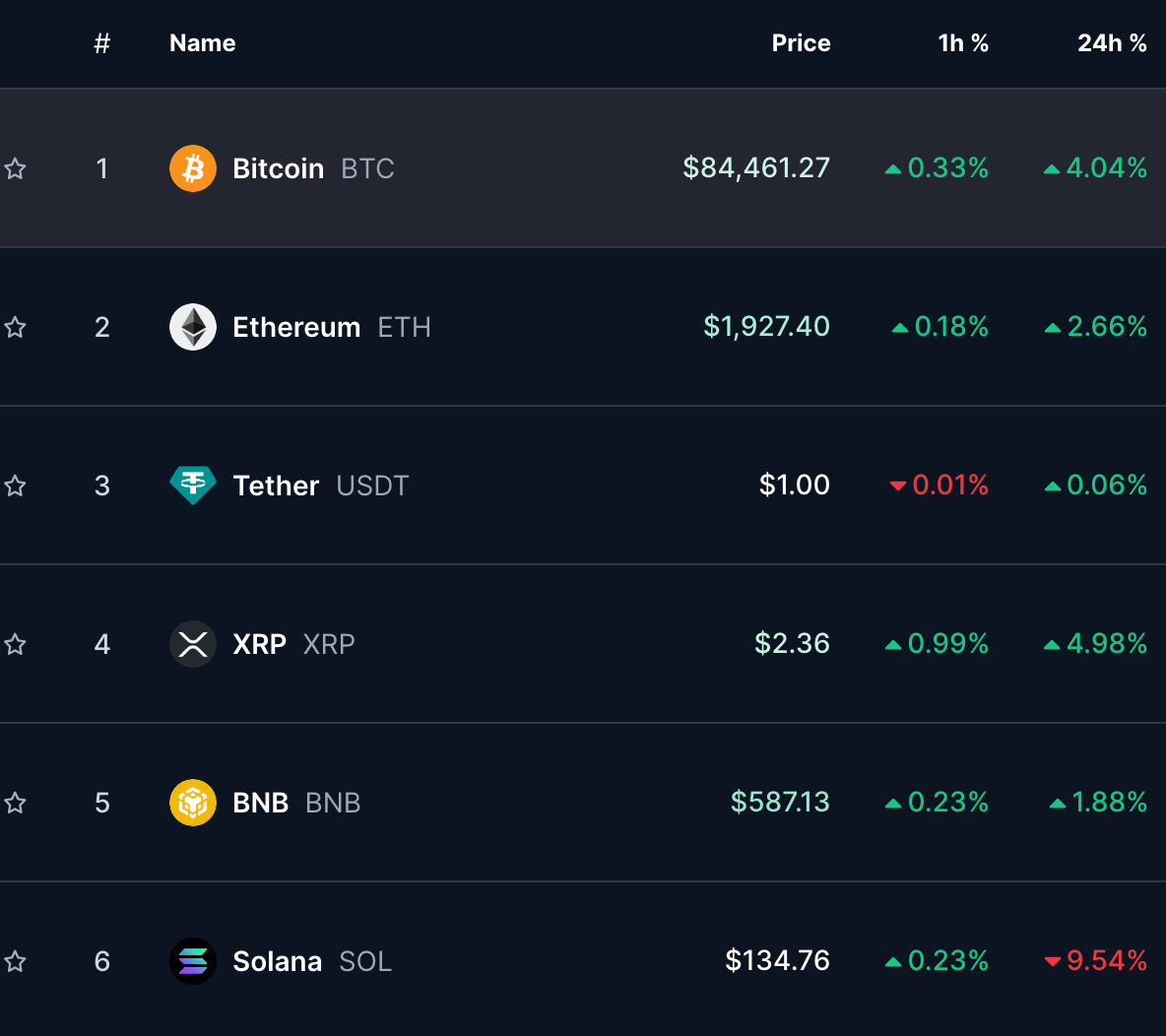

Just when you thought crypto was down for the count, Bitcoin’s back at $85K, up 12% this week. Ethereum, Solana, and even memecoins are catching bids. What gives? Two words: risk appetite.

Stocks’ rebound reminded traders that money printer go brrr vibes aren’t dead. With the Fed likely to cut rates soon (thanks to cooling inflation), crypto’s looking like a high-beta bet on liquidity. Plus, Bitcoin ETFs saw surprise inflows today—$420 million, reversing weeks of outflows. It’s almost as if Wall Street whispered: “Fine, we’ll let you sit at the big-kid table… for now.”

But let’s not pop champagne yet. Bitcoin’s still 18% below its ATH, and Ethereum’s gas fees could power a small nation. This isn’t a bull market; it’s a relief rally in a year full of plot twists.

What’s Next?

The stock market’s massive rebound doesn’t necessarily mean we’re in the clear. The volatility we’ve seen this week reflects a deeper uncertainty about the economy, politics, and global stability. Investors may be celebrating today, but the undercurrents—rising gold prices, geopolitical tensions, and the unpredictability of Trump’s trade policies—suggest that caution is still warranted. The real question is whether this rally is the start of a sustained recovery or just another head fake before more turbulence ahead. Either way, one thing is clear: this market isn’t for the faint of heart.

One thing’s clear: In 2025, the only certainty is whiplash. Buckle up, it’s going to be a long ride.

Stay ahead of the chaos. Subscribe for real-time breakdowns.