Market Meltdown 2025: Why Stocks & Crypto’s Crash Is a Contrarian’s Dream

Why Today’s Chaos Might Be 2025’s Best Buying Opportunity

Washington’s new economic war isn’t just with China—it’s with itself. Fresh tariffs on Canada and Mexico have turned trade policy into a political Molotov cocktail, igniting a market meltdown where crypto is the collateral damage. Bitcoin and Ethereum tanked as investors fled risky assets, $120M vanished in 60 minutes, and Trump’s tweets wield more power than Fed chairs. The question isn’t ifcrypto survives, but who’s left standing when the smoke clears.

The Tariff Tumble: How Trade Wars Tanked Everything

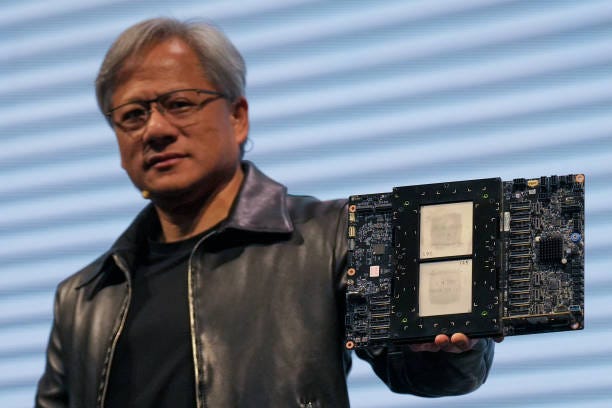

Last week, the Trump administration dropped a regulatory bombshell: sweeping new tariffs on imports from Mexico and Canada. The move, framed as a bid to “protect American jobs,” backfired spectacularly. Markets interpreted it as a return to 2018-style trade war chaos—and panicked. The S&P 500 logged its worst week since September 2024, Tesla cratered 50% from its highs, and even blue-chip tech giants like Nvidia (-30%) and Meta (-18%) got caught in the crossfire.

Why This Feels Familiar

History rhymes: Tariff tantrums always spark short-term panic. In 2018, Trump’s China trade war erased $5 trillion from global markets—only for stocks to roar back once tensions cooled. This time, the sell-off feels amplified by fragile post-election optimism and overstretched valuations. Hewlett Packard’s 13% plunge (blaming tariffs and layoffs) and Costco’s supply-chain jitters are textbook examples of fear-driven overreactions.

The Hidden Upside

Extreme volatility often masks opportunity. Tesla’s 50% haircut, for instance, ignores its still-dominant EV market share and upcoming AI-driven robotaxi rollout. Similarly, Nvidia’s AI chip monopoly isn’t vanishing because of tariffs. For investors with grit, this is a chance to buy world-class companies at Black Friday prices.

Crypto’s Double Whammy: ETF Fatigue & Ethereum’s Existential Crisis

Crypto didn’t escape the carnage. Bitcoin ETFs, once hailed as Wall Street’s gateway to digital gold, saw inflows evaporate faster than a meme coin’s liquidity. After months of institutional hype, the $40 billion ETF experiment is facing its first real stress test—and it’s wobbling. Meanwhile, Ethereum’s “Pectra” upgrade, a last-ditch effort to stay relevant against Solana and Avalanche, has investors asking: Is this ETH’s midlife crisis?

The ETF Paradox

Bitcoin’s 20% drop isn’t just about tariffs—it’s about expectations. ETFs were supposed to bring stability, but institutions are now retreating to bonds and gold, leaving retail traders holding the bag. The silver lining? ETF outflows often signal capitulation, the final flush before a rebound.

Ethereum’s Make-or-Break Moment

The “Pectra” upgrade promises faster transactions and lower fees, but Ethereum’s real problem isn’t tech—it’s narrative. Solana’s speed and Coinbase’s Base chain are stealing its thunder. Still, ETH’s ecosystem (DeFi, NFTs, L2s) remains unmatched. If Pectra delivers, Ethereum could stage a comeback worthy of a Marvel movie. If not? Well, even superheroes have bad days.

Regulatory Headwinds

New U.S. rules targeting stablecoins and exchanges added fuel to the fire. But heavy-handed regulation often precedes maturation (see: post-2008 banking reforms). For crypto, this could weed out weak players and set the stage for sustainable growth.

The Silver Lining: Why This Could Be 2025’s Bottom

Let’s cut through the noise: Markets thrive on extremes. When everyone’s fleeing, the seeds of recovery are already sprouting.

Stocks: Fear = Fuel

The S&P’s Fear & Greed Index hit “Extreme Fear” levels last seen during the 2024 crypto winter. Historically, buying at these lows has paid off handsomely. Tesla’s 50% plunge? It’s still up 800% since 2020.

Crypto: Blood in the Streets

Bitcoin’s 20% dip feels apocalyptic, but zoom out: It’s still 120% above its 2024 lows. ETH’s existential crisis? Similar doubts plagued it before the Merge—and it rallied 90% afterward.

Macro Tailwinds

Jerome Powell’s reassurance that the economy is “in a good place” matters. Low unemployment, slowing inflation, and resilient consumer spending suggest this sell-off is emotional, not structural. Tariffs might sting, but they’re a temporary speed bump—not a roadblock.

The Takeaway: Panic is a Terrible Strategist

Markets don’t crash in straight lines—they zigzag on fear, greed, and headlines. Today’s meltdown isn’t a death knell; it’s a stress test.

For HODLers: This is your Star Wars trench run moment. Stay steady.

For Bargain Hunters: Quality stocks (and crypto) are on sale. Think Nvidia, Bitcoin, Costco.

For Skeptics: Watch for capitulation signals—like Tesla’s Dan Ives doubling down on $550 price targets.

The smart money isn’t panicking. It’s planning.

Stay sharp. Markets reward the patient. 🔗 Subscribe for real-time crisis-to-opportunity breakdowns

P.S. If you sold everything, it’s okay—just don’t forget to buy back lower. Your future self will thank you.